Liga Asuransi – Dear readers, how are you? We hope that your business is running smoothly after passing a difficult time due to the COVID-19 outbreak.

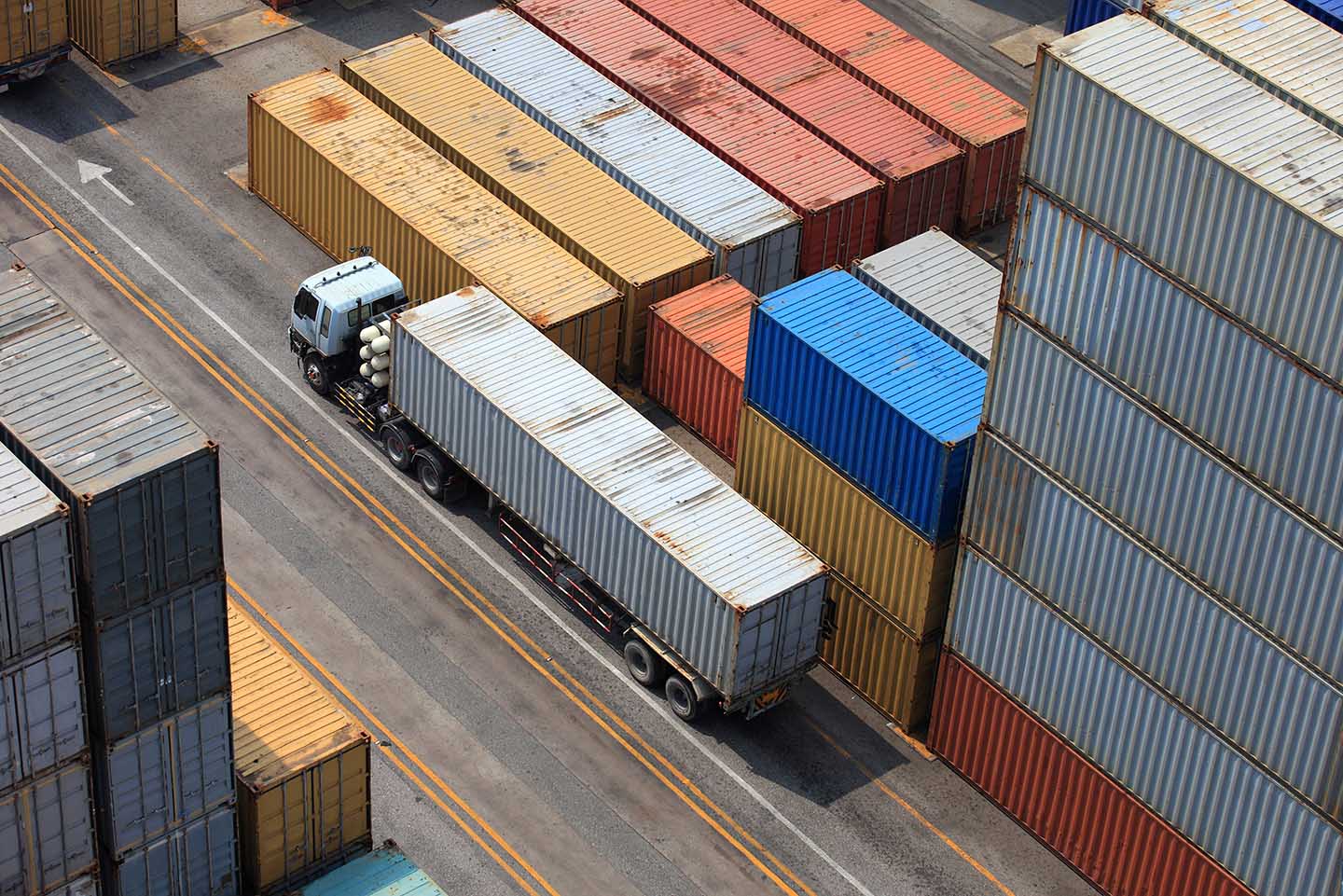

This time we will be discussing the Marine Open Policy (MOP), a special program for freight forwarding insurance for entrepreneurs who have a regular volume of goods transportation and in large quantities. Especially import and export traders. Every imported and exported item always requires shipping insurance (marine cargo Insurance).

The problem is who insured it? For export, if the insured is the importer (buyer) then the insurance premium is the obligation of the importer abroad and it is certain that they will buy insurance from the insurance company in their home country.

Likewise, for imported goods, if the agreement is that the exporter abroad is obliged to insure, then they will buy insurance from the insurance company in their country.

In fact, export and import insurance can be purchased from insurance companies in Indonesia. But unfortunately, there are still many traders who do not prioritize the use of insurance in the country.

As an illustration, in 2021 Indonesia’s imports amounted to USD 15.21 billion and exports amounted to USD 67.38 billion so the total exports and imports amounted to USD 82.59 billion.

If the average marine cargo insurance premium tariff is 0.1% of the total import and export value, the potential domestic insurance premium income is USD 82,590,000. A very fantastic figure for the insurance industry in Indonesia.

In business, insurance arrangements by importers and exporters are profitable for traders.

For imports, by handling the insurance yourself, you can negotiate insurance coverage and competitive premium rates. Then if there is a claim, you can take care of it yourself because the insurance company is in Indonesia.

Likewise, for exports, sellers have a strong bargaining position to arrange insurance coverage when goods depart from Indonesia, this is to ensure that if there is a ship accident and the goods are damaged or lost before arriving at their destination, it is likely that the importer (buyer) will not pay you. However, if the goods have been insured by exporters in Indonesia, then exporters can claim to the insurance company in Indonesia.

It should be noted that the strategy of using domestic insurance companies has been carried out by several countries. Now is the time for Indonesia.

To take this opportunity, please ensure that export and import are subject to incoterm CIF (cost insurance and freight). It is good for your protection, good for domestic insurance companies, and also for the country’s balance of payment.

One of the best ways to arrange freight insurance coverage is to use the Marine Open Policy (MOP) program. For further explanation please continue with the writing below.

If you are interested in this piece of the article, please share it with your colleagues so that they also understand like you.

As recently published by the ministry of finance of Indonesia that export and Import Performance Continues to Strengthen, and Indonesia’s Trade Balance Records 29-Month Surplus.

Just for the October 2022 transaction in October 2022 Indonesia again recorded a trade balance surplus of USD4.99 billion, so cumulatively the trade balance surplus from January to September 2022 reached USD39.87 billion, or much higher than the trade balance surplus at the peak of the commodity boom period in 2011 which was USD22, 2 billion.

Indonesia’s trade balance surplus is partly attributable to the strengthening of exports and imports. It is known that Indonesia’s exports again recorded a positive performance in September 2022 with a value of USD24.80 billion or grew 20.28% (yoy).

This can be seen from exports from January to September 2022 which reached USD219.35 billion or an increase of USD55 billion compared to the same period the previous year (USD164.32 billion).

Related to imports of consumer goods, although they decreased on an annual basis by 11.17% in between due to price increases, cumulatively from January to September, imports of goods.

The Needs for Marine Cargo Insurance

Marine insurance is concerned with insuring vessels, cargoes, and related marine liabilities. The premium income of Indonesian marine cargo insurers is an important contribution toward the Indonesian balance of payments and represents one of the few ‘invisible’ in international trade where the services involved in importing and exporting cargo can be wholly provided from within Indonesia.

The demand for marine cargo insurance closely follows the trading pattern of the Indonesian economy. It covers many risks associated with exporting primary products and importing agricultural-related goods, raw materials for manufacturing, manufactured goods, and consumer items.

The strength of a marine insurance market is measured by the skills and judgment of experienced underwriting personnel and the capacity to insure a broad range of risks. Indonesia is at one end of some of the world’s longest trade routes.

Our economy is totally reliant on this trade to sustain the standard of living enjoyed by Indonesian. Such trade requires the best in supporting services such as insurance, banking, transportation, and communications. We believe it is essential for Indonesia to continue to have and maintain a strong and substantial marine insurance market.

Anyone who is at risk of suffering a financial loss should cargo be lost, damaged, or destroyed – or who would benefit from the safe arrival of the cargo – has an insurable interest and a need for cargo insurance.

What is a Marine Open Policy?

A marine cargo open policy is the agreement between a merchant and an insurance company to insure all goods in transit falling within that agreement for an agreed period or even indefinitely until the agreement is cancelled by either party.

The policy is ‘open’ in so much as goods meeting the agreed description are automatically insured while in transit to and from Indonesia without the need to notify the insurer of each shipment’s details.

The policy specifies:

- Who is insured, and who the insurers are.

- The general description of the goods.

- The countries or places to or from which the goods will be insured.

- The maximum value payable under the policy.

- How the goods will be valued.

- The conditions of insurance. The merchant agrees to declare details of all shipments falling within the scope of the policy, and the insurance company agrees to insure such shipments, according to the terms and conditions of the policy. This includes a general description of the goods, which can be either narrow or broad in scope.

Usually, an open policy has maximum limits per cargo sending. There may be two limits – per vessel, and per location.

Some terminology may be confusing: the per vessel limit may be described as the ‘Bottom Limit’ which is a traditional phrase meaning the ship’s bottom or its hull, so it is in fact the highest limit the

As every shipment is at equal risk on the high seas, it is necessary to insure all cargo shipments – companies transacting in large volumes can find this cumbersome.

An Open Policy in Marine Insurance can help protect multiple shipments insured until the policy is canceled or till the sum insured is exhausted, whichever comes first. This allows companies to carry out transactions and rest assured as their cargo shipments are automatically and successively insured.

An open Marine Policy is called a Floating Policy as the insurer need not buy individual policies for each consignment and each transit journey.

This policy protects your business from losses occurring due to sinking, fire, explosion, natural calamities, etc. This policy is ideally purchased by businesses involved in the business movement of goods, for instance, merchants, import-export organizations, banks, shipping agencies, etc.

The Advantage of Marine Open Policy?

Features of Open Marine Policy

- Insurance coverage of multiple shipments

- Successive shipments are automatically covered until the sum insured is exhausted

- Annual premium covers all shipments and journeys

- A strong network of surveyors for easy claim procedure

- Hassle-free claim settlement

Key Benefits of Open Marine Policy:

Comprehensive coverage.

As the name suggests, an Open Policy in Marine Insurance will cover an indefinite number of shipments in transit.

Under this policy, the business covers the cargo for a certain sum insured.

Until this sum is exhausted or until the policy is canceled, the insurer will cover any number of shipments – this gives the business a wider coverage from risks and eliminates the hassle of having to purchase multiple policies. Also, the business must simply declare the successive shipments to the insurer, and they are automatically covered under this policy.

No need to buy multiple policies

An Open Marine Insurance Policy eliminates the need to buy an insurance policy for every single voyage and shipment.

Businesses can purchase a single insurance policy to cover a larger number of transits and shipments within a certain period, allowing you to protect your shipment without any hassle.

Exceptions to the Open Marine Policy

The Open Marine Policy does not cover loss or damage to cargo in the event of the following:

- Willful misconduct of the insured

- Any deliberate damage to the cargo or losses occurring due to willful misconduct will not be covered by the Open Marine Insurance Policy.

- Insufficiency or unsuitability of packing or preparation of the cargo insured

- Businesses need to ensure that the shipment is suitably packed. Damage/losses occurring due to insufficient safety precautions while packing or unsuitable packing or preparation of the cargo shipment are not covered under this insurance policy.

- Ordinary leakage, ordinary loss in weight or volume, ordinary wear and tear, and inherent flaws in the cargo insured

- Any kind of ordinary/normal wear and tear, losses in weight or volume, or leakage while in transit is not covered under the insurance policy.

- Delays due to shipments being detained at customs, ship maintenance, and unsuitable weather conditions causing transit delays are not covered under the insurance policy.

- Un-seaworthiness of the vessel

- Businesses need to ensure that the vessel used in transit abides by the marine law of seaworthiness. This means that the ship should be in the condition or reasonably fit to encounter perils at the port and at sea. If a ship bearing the shipment is sent out to sea when it is in an unworthy sea state, the insurer is not liable to cover the cost of damages attributable to unseaworthiness.

How to buy Marine Open Policy?

As you may know that arranging all insurance policies need special knowledge to get the maximum coverage and a simple claim process in case of an accident happens.

The best way to have a MOP is by using the service of a legal insurance broker. An insurance broker is the insurance expert that works on your behalf.

With his knowledge and experience, an insurance broker will design a quality MOP for you and place it on several insurance companies to negotiate the widest coverage, high-quality security, and a competitive premium.

The most important is that the insurance broker will help you in settling the claim from the date of the accident until the full payment from the insurers.

One of the leading insurance brokers in Indonesia for Marine Cargo Insurance is L&G Insurance Broker.

For all your insurance needs please L&G now!

Sources:

- https://corporategeneralinsurance.adityabirlacapital.com/marine-insurance/open-marine-policy

- https://www.policybazaar.com/corporate-insurance/articles/difference-between-marine-open-cover-and-marine-open-policy/

- https://www.kemenkeu.go.id/informasi-publik/publikasi/berita-utama/surplus-neraca-perdagangan

—

LOOKING FOR INSURANCE PRODUCTS? DON’T WASTE YOUR TIME AND CONTACT US RIGHT NOW

L&G HOTLINE 24 HOURS: 0811-8507-773 (CALL – WHATSAPP – SMS)

website: lngrisk.co.id

E-mail: customer.support@lngrisk.co.id

—