Liga Asuransi – Welcome owners, managers and operators of Solar Power Plants (PLTS) in Indonesia to our blog dedicated to discussing risk management and insurance in the renewable energy sector. Here, we offer an in-depth look at ways to protect your investments from a variety of possible risks. If you found this article useful, we invite you to share it with colleagues in the industry. Additionally, explore hundreds of other articles on this blog that provide reliable and up-to-date sources of information on insurance and risk management in the renewable energy sector.

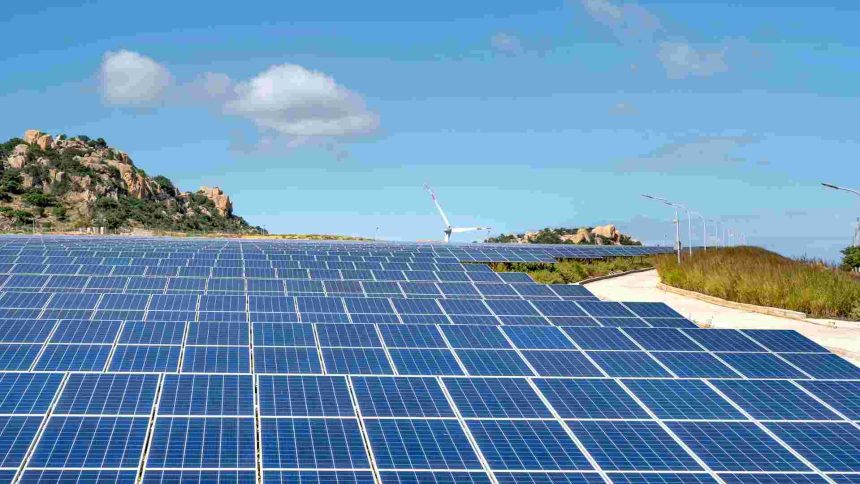

In this modern era, renewable energy has become the main focus in global efforts to reduce dependence on fossil fuels and reduce carbon emissions. Solar energy, as one of the fastest growing renewable energy sources, plays a vital role in this energy transformation. In many parts of the world, including Indonesia, investment in solar panel technology is increasing rapidly, driven by government initiatives and growing interest from the private sector.

However, with this large investment comes significant risk. Extreme weather, equipment damage and other risk factors can threaten the efficiency and operational sustainability of solar power plants (PLTS). This is where the role of insurance becomes crucial. PLTS insurance not only protects against physical loss, but also helps secure income streams in situations of operational disruption or natural disasters. As such, insurance becomes an important tool in ensuring that investments in solar energy can thrive and provide stable returns in the long term. Insurance provides peace of mind for investors and PLTS owners, ensuring that their assets are protected and operations can continue even in unexpected conditions.

Understanding Solar Panel Insurance

Solar panel insurance is an insurance product specifically designed to protect investments in solar panel technology from various risks. This insurance covers damage or loss of solar panels due to accidents or natural disasters and operational disruptions that could hinder energy production. With the rapid growth of solar energy infrastructure, this insurance has become important to maintain production continuity and investment efficiency in the renewable energy sector.

Scope of Solar Panel Insurance Coverage

Solar panel insurance generally covers several main aspects:

- Physical Damage: Protects solar panels from physical damage due to natural disasters such as hurricanes, earthquakes, floods, or from unexpected events such as fire and vandalism.

- Operational Disruption: If damage to a solar panel results in a cessation of energy production, this policy may cover loss of income during the restoration period.

- Damage due to installation errors: Covers the costs of repairing or replacing solar panels damaged due to installation errors or component failure.

How Insurance Mitigates Solar Power Plant Risks

In the solar power generation (PLTS) industry, insurance plays a vital role in managing and mitigating risks. With risks including physical damage, operational disruption, and regulatory changes or market volatility, having a comprehensive insurance policy can be a game changer in maintaining business stability and continuity. The following is a detailed explanation of how insurance can protect investments in PLTS and several examples of insurance implementation in overcoming major risks.

Protection Against Physical Damage

Solar PV insurance provides coverage for physical damage that can be caused by various things, such as bad weather, fire, or even vandalism. The insurance policy will cover the costs of repairing or replacing damaged panels and other equipment. This is very important because the costs of replacing PLTS components can be very high, especially if major damage occurs.

Case study:

A PLTS in Sulawesi suffered significant damage due to a strong storm. Their insurance, which covers damage from natural disasters, helps the company quickly replace damaged panels and restore production capacity without disrupting long-term operations.

Overcoming Operational Downtime

Downtime can occur for a variety of reasons, including equipment failure or routine maintenance. Business interruption insurance helps mitigate financial losses during this period, providing funds for fixed costs or even lost income. This ensures that solar PV can survive difficult periods without heavy financial pressure.

Example:

In a PLTS project in West Java, an inverter failure occurred which resulted in operations having to be stopped for several weeks. A business interruption insurance policy compensates for lost revenue, allowing the project to continue with minimal financial loss.

Responding to Regulatory Changes and Market Volatility

PLTS also faces risks from changes in government policy or fluctuations in energy market prices. Insurance that considers regulatory and market risks can provide additional insurance against sudden changes that could affect profits or operational costs.

Benefits of a Comprehensive Insurance Plan

Having a comprehensive insurance policy provides several long-term benefits:

Business Continuity:

Ensure that operations can run smoothly even if there are unexpected incidents.

Financial Stability:

Provides financial guarantees so that PLTS does not need to allocate large reserves for potential risks, enabling more investment in innovation and expansion.

Legal certainty:

Provides protection in cases of lawsuits or claims from third parties that may occur due to incidents at PLTS locations.

Insurance is not only a layer of protection but also a strategic component in planning and executing PLTS projects. A well-designed policy helps ensure that any identified risks can be managed effectively, making investment in renewable energy safer and more attractive to stakeholders.

How Does Insurance Mitigate Solar Power Plant Risks?

In the renewable energy industry, especially solar power plants (PLTS), insurance plays a critical role in managing risks and ensuring operational sustainability and financial stability. Insurance provides comprehensive protection against a number of risks that could hamper efficiency or even stop solar energy production completely. Below is a detailed explanation of how insurance policies work in this context, including some case studies and the important role insurance brokers like L&G Insurance Brokers play in this process.

- Protection from Physical Risks

Insurance policies for solar PV generally cover physical damage to equipment, which can be caused by natural disasters such as hurricanes, floods, earthquakes, or other incidents such as fire and vandalism. This insurance not only covers the costs of repairing and replacing damaged components but also often covers the costs of cleanup and waste disposal after an incident.

Case study:

A solar power plant in Bali suffered serious damage due to widespread forest fires. Thanks to their property insurance, the plant was able to quickly repair and replace damaged panels, at a cost covered by the insurance company, ensuring that their downtime was minimal.

- Overcoming Operational Downtime

Business interruption insurance is an important element in a solar PV insurance policy, providing financial compensation for lost revenue during periods when the plant is unable to operate normally due to damage or repairs. This is vital to maintaining financial stability and meeting financial obligations during the recovery period.

- Handling External Risks

Regulatory changes and market volatility can have a significant impact on PLTS operations. Certain insurances can offer protection against regulatory risks, ensuring that companies can adapt to policy changes without major financial losses.

Benefits of a Comprehensive Insurance Program

Having a comprehensive insurance plan helps ensure that all aspects of solar PV operations are protected. From physical damage to operational disruptions and external risks, insurance provides a safety net that allows companies to focus on growth and development rather than worrying about potential risks.

Role of Insurance Broker

Insurance brokers play a key role in identifying the specific needs of each power plant and drafting appropriate insurance policies. L&G Insurance Brokers, with expertise and experience in the renewable energy sector, helps clients not only choose the right coverage but also in the claims process and negotiations with insurance companies. With the help of a broker, solar PV companies can ensure that they have the most effective insurance coverage, tailored to the unique risks they face.

By integrating insurance into operational strategies, solar PV can increase their resilience to disruptions and maximize potential return on investment in this competitive and high-risk renewable energy market.

Long Term Benefits of Insurance for Renewable Energy Projects

Insurance has a significant role in supporting the sustainability and long-term viability of investments in solar energy projects. By offering a financial safety net, insurance helps ensure that renewable energy projects can survive the challenges and risks that may arise during their operations. Here are some of the ways in which insurance supports sustainable development in the sector:

- Supporting Operational Sustainability:

Insurance helps reduce the financial impact of unexpected downtime, equipment damage, or loss of production capacity due to external factors. Thus, insurance allows projects to continue operating or quickly return to operation after experiencing disruption. This is crucial to ensuring that renewable energy projects can achieve and maintain their energy production targets in the long term.

- Minimizing Investment Risk:

Insurance plays a key role in mitigating the risks associated with large initial investments in solar energy infrastructure. By reducing these financial risks, insurance encourages more investors and companies to invest in renewable energy technologies. Investors tend to be more confident when there is insurance coverage that ensures that their capital is protected against unexpected losses.

- Increasing Project Approvals and Funding:

Insurance can help increase project approval rates by providing assurance to lenders and investors that key risks have been addressed. This is often a prerequisite for obtaining funding, especially from financial institutions that require proof of risk mitigation before approving a loan or investment. Adequate insurance can reduce the accelerated risk of project failure, thereby expanding access to capital and funding sources.

Through risk reduction and comprehensive financial protection, insurance plays an important role in promoting the adoption of solar energy and other renewable technologies. These initiatives are not only important for achieving global clean energy targets, but also for ensuring that investments in renewable energy remain productive and profitable in the long term. Thus, insurance becomes one of the main pillars in the sustainability and financial strategy of solar and renewable energy projects.

Conclusion

In a world that increasingly prioritizes sustainability, insurance plays a vital role in supporting and protecting investments in the renewable energy sector, especially solar energy. Insurance not only reduces financial risks associated with physical damage and operational disruptions, but also ensures project continuity in the face of unexpected challenges. This is the foundation that allows investors and project managers to continue their efforts with more confidence in an industry known for its variability and risk.

Given the important role that insurance plays in the solar energy industry, it is highly recommended that project owners, investors and managers consult with insurance professionals who specialize in renewable energy. These professionals can help tailor insurance coverage to suit the specific needs of each project, ensuring that all operational aspects are maximally protected.

To obtain the best security and protection, it is important for stakeholders in the solar energy industry to engage an insurance broker such as L&G Insurance Brokers. With their experience and expertise in managing risks in the renewable energy sector, L&G can provide valuable insights and optimal insurance solutions. Contacting an expert like this not only allows you to get better protection, but also guarantees that your investment is safe, allowing more focus on innovation and expansion rather than worrying about potential losses.

This call to action is a step towards safer and more sustainable investments in solar energy, with insurance as a supporting pillar. Contact your insurance professional immediately to ensure that you and your project are prepared for the bright and challenging future of renewable energy.

Looking for insurance products? Don’t waste your time and contact us now

HOTLINE L&G 24 JAM: 0811-8507-773 (CALL – WHATSAPP – SMS)

Website: lngrisk.co.id

Email: oktoyar.meli@lngrisk.co.id

—