Liga Asuransi – The insurance world is currently in the midst of a whirlwind of surprising global and domestic dynamics. From US President Donald Trump’s 32% tariff policy, which could impact Indonesia’s import and export sectors, to the surge in natural disasters that continues to threaten the community. Amidst this uncertain situation, protection through various types of insurance is becoming increasingly important, for individuals, businesses, and industries. In this roundup, we present seven of the hottest and most comprehensive news stories from the insurance world this week—packed with crucial information you shouldn’t miss!

Beware! Natural Disasters Can Strike at Any Time. Here Are 7 Types of Insurance You Must Have Now!

Natural disasters in Indonesia continue to occur, and their impact is significant. According to data from the National Disaster Management Agency (BNPB), from January 1 to June 3, 2025,1,211 disaster events occurred in various regions. Of this number,floods dominate with 800 incidents, resulting in damage to more than 18 thousand homes and hundreds of public facilities, including schools, places of worship, and health facilities.

Not only was there property damage, but there were also many casualties. As many as234 people died29 people were reported missing, and more than 3.5 million residents were affected and forced to evacuate. Given these conditions,protection from the risk of natural disasters is increasingly important, not only for property, but also for personal safety.

President Director of PT Asuransi Asei Indonesia,Dody Achmad Sudiyar, said there were 7 types of insuranceWhat can provide protection against the risk of natural disasters?

- Property Insurance

Protecting homes, offices, factories and other property assets from damage caused by floods, fires, earthquakes, and volcanic eruptions. Including police types like Property All Risk (PAR) And Earthquake Insurance.

- Motor Vehicle Insurance

Vehicles can also be damaged by floods or other disasters. This insurance provides protection against damage, loss and accidents due to extreme conditions, including fallen trees and landslides.

- Marine Cargo Insurance

For logistics and export-import players, this insurance is very important to protect goods in sea transit from risks such as ship fires, collisions, or disasters in port.

- Personal Accident Insurance

Give compensation in case of accident which can result in disability, hospitalization, or even death. Suitable for individuals, work groups, and public transportation passengers.

- Engineering Insurance

Designed to protect construction projects and machinery installations from disaster risks. Includes policies such asContractor All Risk (CAR), Erection All Risk (EAR), And Machinery Breakdown Insurance.

- Micro & MSME Business Insurance

Disasters can be devastating to small businesses. This product provides protection forMSME assets and operations from the risk of floods, earthquakes, or fires.

- Special Parametric Disaster Insurance

Modern type of insurance that is based on certain parameters, such as earthquake strength or extreme rainfall. The claims process is fast and transparent, eliminating the need for lengthy damage verification processes.

15 Financial Companies on the OJK’s Radar! Who’s at Risk?

The Financial Services Authority (OJK) has emphasized its commitment to further tightening supervision in the financial sector.Insurance, Guarantee, and Pension Fund (PPDP)to protect consumers and maintain the stability of the national financial system. No joke, until June 24, 2025,As many as 15 financial institutions have been included in the OJK’s special monitoring list!

Chief Executive of PPDP Supervisory OJK,Oh Prastomiyono, explained that this strict supervision includes insurance and reinsurance companies, as well as 9 pension funds which are considered to be experiencing serious problems, especially from a financial perspective.

“This step was taken so that the company could immediately improve its financial condition and protect the rights of policyholders and pension fund participants,” Ogi said at an OJK press conference on Tuesday (July 8, 2025).

Furthermore, OJK is also seeking an approach constructive and solution-oriented in handling this problem, so that it does not have a detrimental impact on the wider community as users of financial services.

Most Companies Have Met the Minimum Capital Requirement

Along with the obligation to increase equity in accordance with the provisionsPOJK No. 23 of 2023, Ogi said that as of May 2025,as many as 106 of 144 insurance and reinsurance companies have met the minimum equity requirements that must be met by 2026. This is a positive signal amidst tight supervision.

The Insurance Industry Remains Resilient

From the financial performance side,total assets of the insurance industry in May 2025 was recorded atRp1,163.62 trillion, growing 3.84% compared to the previous year. The sector commercial insurance contributed Rp 939.75 trillion or increased by 4.30% annually.

However, premium income in the January–May 2025 period only rose slightly by 0.88% to Rp138.61 trillion. If detailed:

- Life insurance premiums down 1.33% to Rp72.53 trillion

- General insurance and reinsurance premiums up 3.43% to Rp66.08 trillion

Although premium growth has slowed,the financial health of the industry remains solid. This can be seen from risk-based capital (RBC)which is still far above the minimum limit of 120%:

- Life insurance: 480,77%

- General insurance and reinsurance: 311,04%

Broken or Lost Your Gadget? Don’t Panic! Now There’s Gadget Insurance That Can Save Your Life!

In today’s digital age, losing or damaging a gadget can be catastrophic. From smartphones to laptops to tablets—all of these devices have become an integral part of everyday life. Therefore, gadget insurance is increasingly needed, not only by the tech-savvy, but by anyone who relies on technology.

Financial and insurance observer, Dwi Setyawati, stated that gadget insurance provides very important financial protection, especially because the relatively small premium costs are much lighter compared to the risk of loss due to damage or loss of gadgets.

“This insurance is crucial, especially for those who work flexibly, such as freelancers, content creators, or professionals with high mobility. Imagine if your laptop suddenly broke, your work could be immediately disrupted,” said Dwi.

Real Solution: EasyCover ADLD from Qoala & Home Credit

Answering this need, Qoala and Home Credit Indonesia present EasyCover ADLD (Accidental Damage and Liquid Damage), a device protection service that is much more comprehensive than a regular store warranty.

According to Qoala CEO & Co-Founder Harshet Lunani, people are increasingly dependent on gadgets not only for work, but also for learning, communication, and even maintaining mental health. Therefore, when a device is damaged or lost, it’s not just the item itself that’s lost; it can also disrupt our daily routine.

“EasyCover ADLD is here to maintain the stability of our customers’ digital lives. So that in the event of unexpected damage, they can continue their normal activities without undue stress,” explained Harshet.

Key Features That Give You Peace of Mind

Different from standard protection, EasyCover ADLD offers:

- Protection from accidental physical damage

- Protection against liquid damage

- And the most exciting thing: a temporary replacement phone during the repair period!

With all these benefits, device insurance is no longer an optional option, but a mandatory investment to protect your digital productivity and convenience.

Ups and Downs! Sharia Insurance Assets Increase Annually but Decline Monthly. What’s Really Happening?

The Financial Services Authority (OJK) has just released its latest update on the performance of the Islamic insurance sector in Indonesia. Interestingly, Islamic general insurance assets show a mixed trend: increasing year-on-year, but also decreasing compared to the previous month.

Mirza Adityaswara, Deputy Chairman of the OJK Board of Commissioners, explained that as of May 2025, total assets of sharia general insurance companies reached Rp9.59 trillion. This figure represents a 3.67% increase compared to Rp9.25 trillion in May 2024.

However, compared to the previous month (April 2025), there was a 0.52% decrease from Rp9.64 trillion. This fluctuation indicates that while the annual trend remains positive, the monthly situation requires further scrutiny.

Sharia Insurance Premiums Continue to Grow, Although Slightly

Meanwhile, the Islamic insurance sector as a whole—both general and life insurance—continued to record premium growth. As of May 2025, total Islamic insurance contributions reached IDR 11.17 trillion, a slight increase of 0.23% from IDR 11.14 trillion in the same period the previous year.

Life Insurance Down, General Insurance & Reinsurance Up

In the same report, OJK also explained:

- Life insurance premium income was recorded at IDR 72.53 trillion, a 1.33% decrease compared to May 2024.

- In contrast, general insurance and reinsurance premiums grew 3.43% to IDR 66.08 trillion.

Source: https://keuangan.kontan.co.id/news/aset-asuransi-umum-syariah-mencapai-rp-959-triliun-per-mei-2025

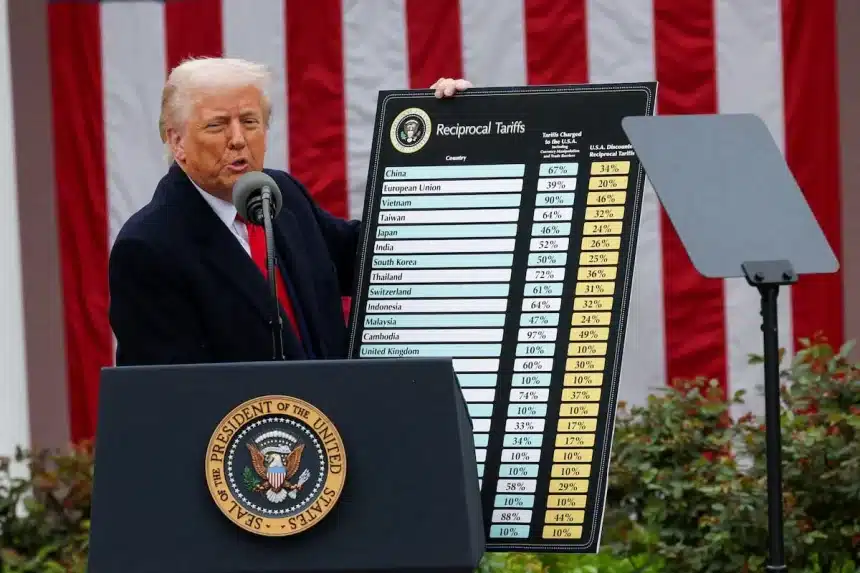

Trump Officially Imposes 32% Tariffs on Indonesia Starting August 1! The Impact Will Be Shocking for the Insurance Sector

United States President Donald Trump has made another breakthrough. On Monday (July 7th), he officially sent letters imposing reciprocal tariffs on several of his trading partners, including Indonesia, Japan, and South Korea. These new US import tariffs are scheduled to take effect on August 1, 2025, and Indonesia will be subject to high tariffs of up to 32%.

This move marks a new phase in the global trade war, which is expected to impact various sectors. Interestingly, however, insurance observer Irvan Rahardjo believes the impact on the marine cargo insurance industry in Indonesia will be relatively minor.

Why Is Indonesian Insurance Safe from Trump Tariffs?

According to Irvan, most Indonesian exports to the US have used the Free on Board (FOB) scheme. Under this scheme, shipping and insurance costs are borne by the buyer in the US, not the exporter in Indonesia.

“So, Indonesian insurance companies don’t record premiums from exports to the US because the importer’s insurance there is the underwriter. The goal is to simplify the claims process at the port of discharge,” Irvan explained on Friday (June 11).

Time to Look for New Markets

However, Irvan urged general insurance companies in Indonesia not to become complacent. He suggested they start targeting new markets outside the United States, particularly countries with more competitive export tariffs.

This way, Indonesian exporters can start requiring insurance coverage to be provided in Indonesia, especially for destination countries that have a network of local insurance partners.

Marine Cargo Insurance Premiums Grow Slightly

According to data from the Indonesian General Insurance Association (AAUI), premiums for marine cargo insurance reached Rp1.71 billion in the first quarter of 2025. This figure represents only a 0.5% increase compared to the same period last year. This slow growth signals the need for a new strategy in this sector, particularly amidst current global uncertainty.

The Government is Still Lobbying the US

Meanwhile, the Indonesian government is currently conducting diplomatic negotiations with the United States regarding the implementation of the 32% tariff. The hope is that this policy can be postponed, reduced, or even canceled.

Kudos! Divers Victims of the KMP Tunu Pratama Jaya Shipwreck Receive Insurance of Up to Rp100 Million, and Compensation for Their Families Reaches Rp1 Billion!

Jasa Raharja Group shows extraordinary concern for the team of divers involved in the search for victims of the sinking of the KMP Tunu Pratama Jaya in the Bali Strait on Wednesday, July 2, 2025. As a form of appreciation and protection for the high risks faced, the divers are now protected by special insurance.

Jasa Raharja’s Acting President Director, Rubi Handojo, stated that the safety of the rescuers is a top priority. Therefore, the diving team is provided with the following protection:

- Death benefit of IDR 100 million

- Maximum maintenance costs of IDR 20 million

- Permanent disability benefits worth IDR 100 million

Aid for the Victims’ Families is No Less Significant

In addition to the rescue team, the Jasa Raharja Group has also distributed assistance to the bereaved families of the victims. As of July 8, 2025, a total of eight families had received assistance, including:

- 6 families in Banyuwangi

- 1 family in Probolinggo

- 1 family in Klungkung

Each heir received a total compensation of IDR 125 million, consisting of:

- Rp. 50 million from Jasa Raharja

- Rp. 75 million from Jasaraharja Putera

If added up, the total compensation that has been distributed reaches IDR 1 billion.

Not Only Money, Logistical Assistance Was Also Distributed

In addition to financial assistance, the Jasa Raharja Group also distributed logistical aid in the form of food to the families of victims awaiting evacuation on the second floor of the ASDP Ketapang Port in Banyuwangi. This was a tangible demonstration of empathy amidst this heartbreaking tragedy.

Extreme Weather is Getting Crazier! Indonesia Re Pushes Parametric Insurance for Automatic Disaster Claims Payment!

PT Reasuransi Indonesia Utama (Indonesia Re) highlights the need for innovation in addressing increasingly unpredictable natural disasters. The solution offered? Parametric insurance—a new protection scheme that’s faster, more objective, and offers immediate disbursement without the hassle!

Indonesia Re’s Director of Engineering and Operations, Delil Khairat, emphasized that climate change has transformed the way the insurance industry operates. He believes that relying solely on technical mitigation is not enough; robust financial protection must also be in place when disasters do occur.

“We need a system that’s not only reactive, but also fast and financially resilient. Parametric insurance is the answer,” he said.Evidence, Friday (11/7/2025).

Claim Without a Survey? Yes!

What is parametric insurance? It’s an insurance model that automatically pays claims based on weather or disaster indicators, such as extreme rainfall or flood levels—without the need for a physical damage survey! It’s perfect for emergencies and hard-to-reach areas.

This scheme is starting to be widely adopted by national reinsurance players, as a response to the increasingly frequent extreme weather in Indonesia.

It’s the Dry Season, But Floods Everywhere!

Unusual weather phenomena further reinforce the urgency of adopting this system. Over the past week, heavy rainfall has hit Greater Jakarta, Sumatra, and West Papua, even though it’s still the dry season!

According to BMKG, these extreme conditions are caused by:

- Cyclonic circulation in Bengkulu

- Tropical storm in northern Indonesia

- Madden Julian Oscillation (MJO) activity

- Warm sea surface temperatures → strengthen the formation of massive rain clouds

Disaster Losses Have Reached Trillions!

The National Disaster Management Agency (BNPB) noted that as of March 2025, total losses due to natural disasters in Indonesia had reached Rp 1,699.67 trillion!

The worst: Bekasi City with total damage of Rp. 659.1 billion.

BMKG warns that this condition will continue and increase the risk:

- Flood

- Landslide

- Strong winds

- Tidal flooding on the coast

Amid geopolitical tensions and the growing threat of disasters, Indonesia’s insurance industry has proven its resilience through innovation, tighter oversight, and real protection for the public. However, choosing the right insurance is not always easy.

That’s where L&G Insurance Broker comes in. As an independent insurance broker, L&G is committed to serving your best interests—not the insurance companies’. With extensive experience in managing a wide range of risks—from natural disasters and imports to property and construction projects—L&G is ready to help you secure the right protection at competitive premiums.

Call us now at 0811-8507-773for free insurance consultation and the most appropriate protection solution for your needs.

Because in a world full of risk, insurance is no longer an option—it’s a necessity.