Liga Asuransi – The development of the insurance industry is always interesting to follow, and this time we have summarized 7 news related to insurance that you should know.

If you are interested in this article, please share it with your colleagues so they can understand it like you.

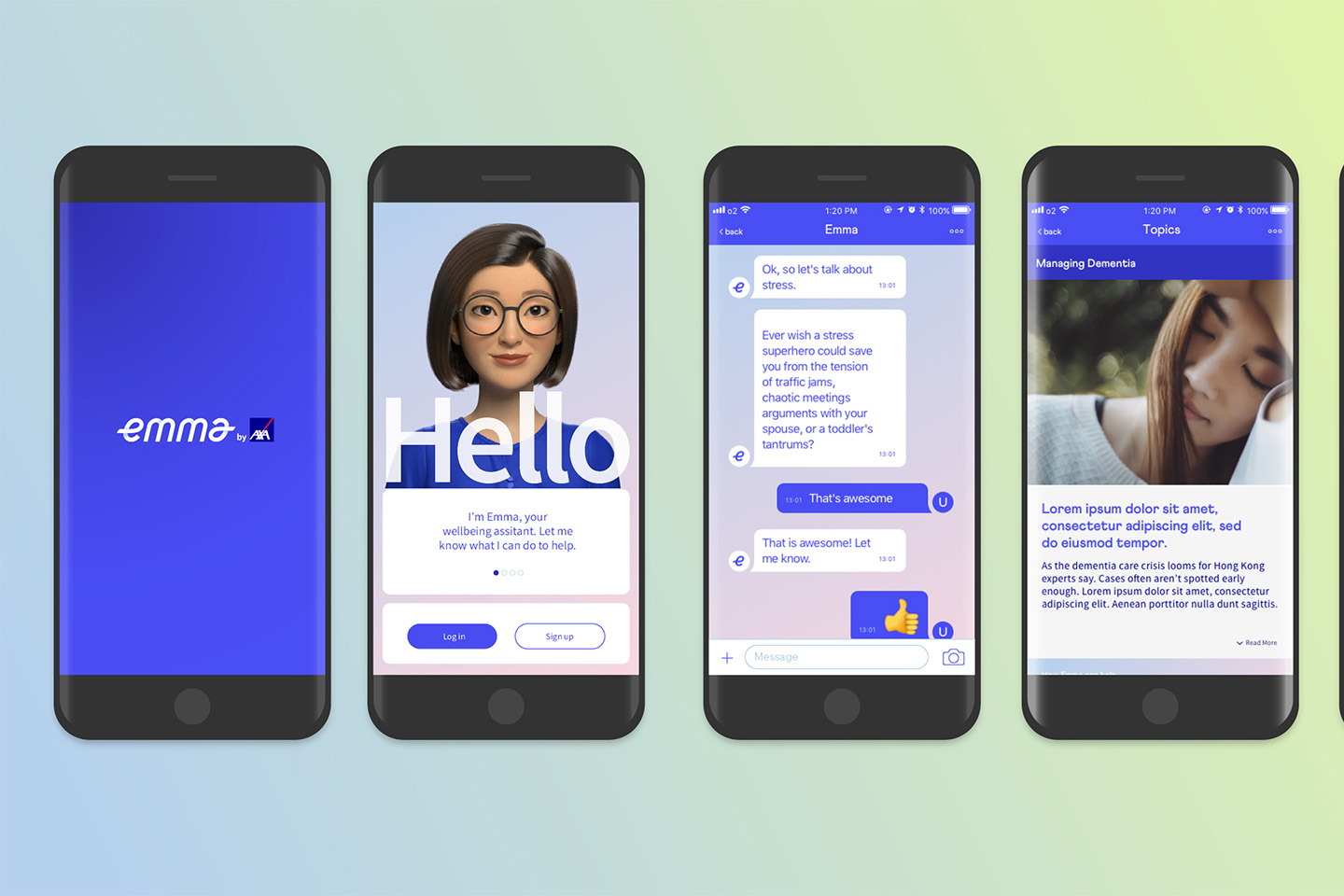

Insurance Company Accelerates Business Through Digital Application Development

For example, PT AXA Financial Indonesia (AFI) recently introduced the Emma by AXA application, which aims to make it easier for clients and the public to manage policies and provide various financial and health information.

Niharika Yadav, President Director of AXA Financial Indonesia, stated that Emma provides a comprehensive range of digital services. This includes information on policies, investments, unit prices, insurance claim status, teleconsultation services, coverage solutions, a list of partner hospitals, and even home workout videos.

“Emma also offers healthy lifestyle inspiration, financial management tips, and lifestyle trends on one platform,” she said in Jakarta on Tuesday (8/8).

Initially, this application was only available through the web base, but now it has been developed into a more complete application.

PT BNI Life Insurance is also developing digital applications, such as Plan Blife, and applications from its parent entity, BNI Mobile Banking.

Eben Eser Nainggolan, Plt. The Main Director of BNI Life said that from a business perspective, sales of BNI Life through digital platforms, in cooperation with BNI and other partners, have increased significantly compared to the previous year.

Eben explained that the Plan Blife and BNI Mobile Banking applications could enable customers to purchase insurance quickly, efficiently, and affordably.

“This advantage certainly has a positive impact on the company, especially in penetrating BNI Life insurance to BNI customers,” he explained.

Eben revealed that this year, the number of customers who have purchased BNI Life insurance products through digital platforms has reached around 40,000 policies.

“Although the development of this application requires significant investment, we believe it will become a new and growing distribution channel for the company,” he added.

PT Asuransi Jiwa Generali Indonesia is also actively developing its digital application. The process involving customers is now entirely carried out through a digital platform.

Vivin Arbianti Gautama, Chief Marketing and Customer Generali Indonesia, explained that this company focuses on technology optimization with a high-touch and high-tech approach.

“These two approaches mean that Generali continues to provide direct service to customers because we believe customer needs are diverse. However, on the other hand, we are also trying to optimize digital technology so that the process is faster and more efficient,” he explained to Kontan.

Vivin explained that the progress of digital applications could be seen from the ability of prospective customers to conduct online consultations, apply for policies, and pay the first premium safely through the iPropose application.

“The Gen iClick application lets customers make policy transactions and submit claims online. In addition, Generali Indonesia also has online insurance products that are fully accessible through digital platforms, such as ALIVE by Generali and Syariah-based Akuberbagi.com, ” he added.

He mentioned that most of the policy transactions, including filing and processing of claims, can already be done digitally.

“The various innovations that we have developed are part of our long-term investment to create a safer future for the people of Indonesia,” he concluded.

Until June 2023, Life Insurance Company Sharia Unit Premiums Increase

Several life insurance companies with Sharia divisions have announced that they have recorded an increase in premium contributions until June 2023.

Iwan Pasila, Main Director of BRI Life, revealed that as of June 2023, the total new contribution from the Sharia unit had reached IDR 141 billion, representing a growth of around 18% YoY. He explained that agent and corporate channels support BRI Life’s Sharia portfolio.

Meanwhile, BRI Life also reported positive premium growth in the Sharia unit.

Eben Eser Nainggolan, Finance Director of BNI Life, stated that the Sharia unit has also experienced increased market share. However, he did not provide details regarding the premium growth.

“Currently, premium growth is driven by increased penetration among individual customers,” Eben told Kontan.co.id on Wednesday (9/8).

Eben added that investment returns also experienced a positive increase, with most of the composition comprising sukuk in the BNI Life Syariah Unit.

On the other hand, the Financial Services Authority (OJK) has issued regulations regarding separating the Sharia division.

Regarding this matter, BRI Life welcomes this policy. Iwan Pasila considers that the obligation to separate this division is meant to optimize development, but it is also necessary to ensure that economies of scale can still be achieved.

Provision of KTA Insurance in Duren Sawit by Bacaleg Perindo to Meet Community Needs

Three legislative candidates from the Perindo Party for DPRD DKI Jakarta, representing East Jakarta Dapil V, together with East Jakarta Perindo Youth DPD, held a distribution of insurance Membership Cards (KTA) on Jalan Duren Sawit Raya, Klender, Duren Sawit on Friday (4/ 8/2023). This activity aims to provide KTA insurance to residents, online motorcycle taxi (ojol), and public transport drivers.

Agung Santoso, Perindo’s candidate for the legislature from East Jakarta Electoral District V, stated that the Perindo Party, a modern party that cares about the ordinary people, is working hard to create jobs and prosperity for Indonesia. Residents highly appreciated this effort, mainly when the distribution of KTA insurance was carried out.

“This is clear evidence that Perindo is here to meet the community’s needs,” Agung said on Friday (4/8/2023).

The KTA insurance program from the Perindo Party, which received serial number 16 on the 2024 election ballots, protects against accidents and grief compensation services.

“This KTA insurance is valid for one year until June 2024 and is provided free of charge to all people who need it,” he explained.

George Fernando Dendeng, Perindo legislator candidate from East Jakarta Dapil V, added that the distribution of KTA insurance was also part of the Blessing Friday event.

“This Blessed Friday activity is a form of our concern by sharing with the community,” said George.

The Blessing Friday activity and the distribution of KTA insurance are part of the vision and mission of the Perindo Party, which supports people’s welfare.

Innocentio Ryan Adityas, East Jakarta Perindo Youth DPD Chairman, added that the Friday Blessing activities would continue to be carried out due to the high enthusiasm of the community.

“We have proven that we can collaborate with fellow legislator candidates in supporting the Perindo Party in East Jakarta,” said Ryan, who is familiarly called Inno.

The Perindo party, led by Chairman Hary Tanoesoedibjo and supports presidential candidate Ganjar Pranowo, focuses on distributing KTA insurance to casual workers who are mostly on the road. He stressed that these workers included ojol drivers and angkot drivers.

Cooperation Between National Health Insurance and Insurance Will Create Quality Services

Improvement of Domestic Health Services Connected with Strong Synergy between National Health Insurance (JKN) and Private Health Insurance

In his research, Arief Rosyid Hasan, Commissioner of Bank Syariah Indonesia, reviewed the importance of the synergy between JKN and private health insurance in improving health services in Indonesia. He observes that currently, there is an overlap in services guaranteed by JKN and private health insurance, which leads to potential waste and overlapping claims.

Hasan explained, “This can result in wastage or even double claims. However, if the patient has JKN and Supplemental Health Insurance, many things can be managed efficiently through cooperation.”

The overlapping of services guaranteed by the two parties has resulted in inefficiencies in the Indonesian health service system, especially for the 25 million JKN participants whose status is inactive. Hasan reminded the importance of ensuring that every JKN participant is active so that the principle of going royong is maintained.

Hasan referred to the Collaborative Report on Comparative Study of Health Insurance for State Officials, revealing that as many as 32.5% of the 385 respondents to State Civil Servants undergoing inpatient treatment wanted to upgrade to an inpatient room. According to Hasan, private health insurance should be a solution to overcome this desire. “However, there may also be participants with more expectations than they should. Those who want to get a higher class than they should be able to do so with additional health insurance, or pay for themselves the difference in costs that BPJS does not cover.”

Hasan emphasized that closer synergy between JKN and private health insurance is needed. In addition, he mentioned the need for institutional strengthening through the National Social Security Council (DJSN) and coordination in policymaking between the Financial Services Authority (OJK), the Coordinating Ministry for Human Development and Culture (Kemko PMK), which oversees insurance, and the Ministry of Health which handles health services.

It is important to note that Kemenko PMK continuously coordinates various efforts to improve the National Health Insurance (JKN) program. One is the launch of Presidential Instruction Number 1 of 2022 concerning Optimizing the Implementation of the JKN Program in 2022.

Muhajir Efendi, Coordinating Minister for Human Development and Culture, added that the success of the National Social Security System (SJSN) lies not only in the 98% of the population covered by the JKN program, according to the target of the National Medium Term Development Plan (RPJMN), but also in reducing the percentage of spending households or out of pocket in total national health spending. This goal aims to ease the burden on the community by paying for relatively expensive health services.

Plans for Two Insurance Companies in the Astra Group Related to Sharia Unit Spin-off

Two Insurance Companies in the Astra Financial Group are Committed to Developing a Sharia Business Unit Spin-off by OJK Regulations

To comply with the Financial Services Authority (OJK) regulations regarding the separation or spin-off of the Sharia business unit (UUS), two insurance companies under the auspices of the Astra Financial Group confirmed their commitment.

In POJK Number 11 of 2023, OJK has issued regulations regarding separating Sharia units in insurance and reinsurance companies. This regulation requires the insurance company to carry out a spin-off if it fulfills certain conditions, including those related to the value of tabarru’ funds and investment funds that reach at least 50% of the parent company.

One of the insurance companies within the Astra Financial Group that intend to run a spin-off is PT Asuransi Astra Buana (Asuransi Astra).

President Director of Asuransi Astra, Christopher Pangestu, emphasized that the obligation to carry out a sharia unit spin-off was by OJK directives and would be carried out by December 31, 2026.

“Definitely (we will follow the rules). We will adjust to the schedule set by the OJK. The preparations have been going on for quite a long time, even before the PPSK Law was introduced, we have made preparations,” he said when we met in Jakarta on Wednesday (9/8).

Christopher explained that in separating the Sharia unit, it is also necessary to consider the market needs and the group’s strategy.

“Asurasi Astra is part of the Astra value chain. If the parent company remains strong in the future, then we will follow suit. However, if it’s the other way around, we won’t. However, so far, we will adapt it to the group’s strategy and by POJK,” he explained.

Christopher added that the need for capital to run a Sharia business unit spin-off is fine for the Astra Group. This is because the value of the Sharia business unit that will be separated is only around IDR 100 billion.

Christopher also emphasized that the UUS spin-off must strengthen infrastructure, including information technology (IT), underwriting, and other operational support.

Meanwhile, PT Asuransi Jiwa Astra (Astra Life) is still considering a spin-off of the Sharia business unit. This is because the Astra Life Sharia business unit owned by the Astra Group is still relatively new, effective in 2019.

President Director of Astra Life, Nico Tahir, stated that Astra Life’s Sharia business unit is still in development, and its portfolio is relatively small.

“We are still very young and still in the development stage. Our sharia business unit started effectively from 2019-2020,” he said when interviewed in Jakarta.

Asuransi Astra Won 3 Awards As Evidence of the Strength of Financial Foundations

Indonesia is currently facing various challenges and changes triggered by adjustments in the pandemic era and global issues that are difficult to avoid. However, despite this wave of changes, the country’s economic conditions improved in 2022 and showed a positive trend in the first quarter of 2023.

This factor is also supported mainly by the positive performance of business actors in creating a positive corporate environment from various aspects, which contributes to surviving and developing in a more positive direction. Asuransi Astra is also included in this effort.

Through its extraordinary commitment to building a solid financial foundation, Asuransi Astra has won several prestigious awards. Awards won include the 24th Infobank Insurance Awards 2023, the Insurance Market Leaders Award 2023 by Media Asuransi, and the Best Insurance 2023 by Investor Magazine.

At the 24th Infobank Insurance Awards by Infobank Magazine, Asuransi Astra won two categories at once. One of them is the category of General Insurance Companies with a Gross Premium of more than IDR 2.5 Trillion. This award is given to an insurance company with an “excellent” predicate for its 2022 financial statements, which show good financial performance throughout the year.

Furthermore, Asuransi Astra also won the Golden Trophy award, given to companies that have prevailed for five consecutive years according to specific categories. The assessment for this award is carried out through desk research analysis of the latest annual report from Asuransi Astra.

Not only that, thanks to good financial performance and yearly improvements, Astra Insurance has also managed to maintain its position as one of the best general insurance companies in the list of the 15 Best General Insurance Companies announced by Media Asuransi in the 2023 Insurance Market Leaders Award.

Assessment in this category is carried out through an analysis of each company’s financial statements for 2022, focusing on achieving gross premiums recorded in published financial reports.

Asuransi Astra also won the 2023 Best Insurance award from Investor Magazine, where the company was successfully entered as one of three companies that won a distinction in the General Insurance category with assets of more than IDR 5 trillion.

The valuation method for this award involves desk research analysis by the judges, which compares the achievements of each company based on their respective financial statements.

With various innovations implemented and a commitment to providing the best service to customers, Asuransi Astra has won three awards at once. This achievement concretely reflects good financial performance and continues to increase every year.

This achievement is also one of the driving forces for Asuransi Astra to continue directing its vision in providing a sense of security to all customers by developing products and services that are continuously being improved.

The financial performance recognized through this award aligns with the rating from AM Best. This global credit rating agency focuses on the insurance industry and is based in the United States. Asuransi Astra has earned a Financial Strength Rating of A- (Excellent) and a Long-Term Issuer Credit Rating of “a-” (Excellent) with a stable outlook.

This rating is based on four assessment factors, including the strength of Asuransi Astra’s balance sheet, which AM Best considers very strong. Operational performance is considered vital, the business profile is considered neutral, and the company’s risk management is considered appropriate. This rating also considers the neutral factor that comes from Jardine Matheson Holdings Limited (Bermuda) as the leading holding company for Asuransi Astra.

“We would like to express our gratitude for the appreciation given by stakeholders, and we also do not forget to thank our customers and partners who have provided support and positive feedback to Asuransi Astra. We will continue to adapt to change through the latest innovations always to meet the needs and desires of customers and provide the best protection for various assets to provide a sense of security to our millions of customers,” said Asuransi Astra’s Finance Director, Maximiliaan Agatisianus.

The Presence of Tap Auto, PT Insurance For All (Tap Insure) Targets 4,000 New Policies This Year

Insurance company PT Asuransi for All (Tap Insure) has introduced a new product called Tap Auto. Tap Insure collaborates with various partner workshops throughout Indonesia in this latest innovation. Tap Auto is a type of protection insurance for two- and four-wheeled motorized vehicles, focusing on digital convenience for consumers and repair shops.

The main advantages offered are that Tap Auto policyholders can obtain policies in digital form in just one working day and a virtual vehicle survey process. After the claim is approved, issuing a Work Order (SPK) is carried out in less than 3 hours, and payments to the workshop are made more quickly.

The launch of the Tap Auto product is part of efforts to expand the range of insurance products by Tap Insure. With this product, Tap Insure has the ambition to issue more than 4,000 vehicle insurance policies by the end of this year.

Cleosent Randing, Director of Operations and Marketing at Tap Insure, said the company is enthusiastic about working with partner workshop networks. He believes this collaboration will help grow the business through the Tap Auto product. Cleosent explained that Tap Auto was created as a comprehensive vehicle insurance solution in Indonesia.

Through the support of sophisticated technology, policyholders can experience a smooth insurance experience from purchase to claim. All of this can be done online safely, quickly, and practically. Cleosent added that consumers who buy a Tap Auto policy also can choose a repair shop from the Tap Auto network throughout Indonesia.

Tap Auto offers premiums in two schemes: All Risk (partial and total loss) and Total Loss Only (complete damage coverage). This protection applies to various types and brands of vehicles. The premium price follows the regulations set by the Financial Services Authority (OJK).

Products like Tap Auto answer the needs of the Indonesian people for vehicle protection, especially since the number of car and motorbike owners continues to increase yearly.

Tap Insure is working with Primasis, a platform provider called BengkelNet, to facilitate the claim process and workshop services. Budi Santoso Asmadi, Managing Director of BengkelNet, welcomes this collaboration and sees Tap Auto as an affordable and practical solution for consumers regarding vehicle protection.

Partner workshops can quickly join Tap Auto by attaching official documents. This is done to ensure that the working seminars can provide the best service for consumers in Indonesia.

Cleosent emphasized that the company will continue to interact with partner repair shops and listen to customer input to improve vehicle protection according to needs. Tap Insure also plans to expand the reach of insurance protection to other sectors, so that access to insurance can be evenly distributed throughout Indonesia.

As an insurance company in Indonesia, Tap Insure has obtained its first general insurance license from OJK in the last three years. With more than 70 partner workshops in Java and Bali and serving consumers in more than 16 cities in Indonesia, Tap Insure continues to carry out its mission to provide better protection for vehicle owners in this country.

This information is provided by: L&G Insurance Broker – The Smart Insurance Broker.

—

LOOKING FOR INSURANCE PRODUCTS? DON’T WASTE YOUR TIME AND CALL US NOW

24 JAM L&G HOTLINE: 0811-8507-773 (CALL – WHATSAPP – SMS)

website: lngrisk.co.id

Email: customer.support@lngrisk.co.id

—