Liga Asuransi – The development of the insurance industry is always interesting to follow, and this time we have summarized 7 news related to insurance that you should know.

If you are interested in this article, please share it with your colleagues so they can understand it like you.

OJK Plans to Make Insurance Class Groupings. This is AAUI’s Response

The General Insurance Association of Indonesia (AAUI) supports the Financial Services Authority’s (OJK) plan regarding grouping insurance companies based on capital. This move aims to strengthen the insurance industry and increase competitiveness by increasing the minimum capital requirements for existing insurance companies.

AAUI Executive Director, Bern Dwiyanto, said that with the capital increase, it is hoped that insurance companies will have a more substantial capacity to deal with risks in the future. However, he suggested that the minimum capital requirements be considered after two years of implementation of PSAK 74, which will take effect from 1 January 2025, so that the impact can be seen more clearly.

Bern considers improving the general insurance industry market conditions more important to make it more conducive. According to him, the general insurance industry will automatically generate greater profits by improving market conditions, directly increasing each insurance company’s capital. In addition, improved market conditions will also encourage the growth of and health insurance industry.

Bern also stated that the plan for grouping the insurance industry was still in the review stage. Therefore, further discussions between OJK, associations, and industry players are still needed. One thing that needs to be discussed is the arrangement between simple and complex insurance products if insurance companies are grouped based on capital.

According to Bern, several companies have low capital but are still healthy and operate in complex or high-risk insurance products. On the other hand, there are also companies with large capital, but most of their product portfolio is simple insurance products. This will create more competitive competition and narrow the market share for this simple insurance product.

Insurance Industry Waits for New Rules Regarding Credit Insurance

Credit insurance claims are the focus of attention from the Financial Services Authority (OJK) and the insurance industry. This was due to increased credit insurance claims during the Covid-19 pandemic.

President Director of PT Asuransi Asei Indonesia, Achmad Sudiyar Dalimunthe, stated that debtors could not pay installments to banks due to the impact of Covid-19, which could potentially cause bad credit. “So credit insurance issued by insurance companies must bear this risk,” said Achmad Sudiyar Dalimunthe, who is familiarly called Dody, when met after the 2023 Indonesia Re International Conference (IIC) in Jakarta on Tuesday (4/7/2023).

Dody explained that the Covid-19 pandemic had also revealed the need for changes in the current credit insurance regulations. This includes managing risk and applying a balanced premium. According to Dody, the many claims during Covid-19 show that the premiums collected need to be balanced. This means that the premium received still needs to be increased.

In addition, Dody also discussed the terminology of long-term credit insurance. The insurance company should have made sufficient reserves if the terminology is long-term. However, most insurance companies have not made reserves by the applicable principles. This is a problem for insurance companies.

“Therefore, insurance companies need to mitigate risk by reconnecting with banks as policyholders to renegotiate terms and conditions so that not all bad credit risks are covered by insurance, but there are limits,” he said.

Dody believes that risk sharing is being pursued in the new regulations regarding credit insurance. The bank will likely bear 30 percent of the risk, and the insurance will cover 70 percent. Thus, not all bad credit risks will be covered by insurance.

In addition, Dody also mentioned the need for regulations regarding tariffs. This is due to the increasing number of credit insurers and several companies whose competencies still need to be fully met.

Dody hopes that the rules regarding credit insurance can be improved. Even though it takes time, on the other hand, banks also may not necessarily agree regarding risk sharing and other matters. “But this is still in process, and the OJK is facilitating this. We will see how this significant business can help the banks because they will bear high risks without insurance,” he said.

On the other hand, the Main Director of PT Reasuransi Indonesia Utama or Indonesia Re, Benny Waworuntu, also welcomed OJK’s efforts to finalize new regulations regarding credit insurance.

“While they are waiting, we carry out proper and good risk selection, which means we don’t refuse at all, but we make sure that what we bear is by the risk mitigation we are doing,” said Benny.

Benny stated that the surge in credit insurance claims was a complex problem, but risk selection was the most crucial. This risk selection not only exists in insurance and reinsurance but must also be carried out by banking or financing institutions and consumers.

“He must be aware of what risks exist, so awareness of these risks is a challenge for all parties, not to mention the business process issues, such as which terms and conditions are covered and which are not covered, including issues of pricing, reserves, management, etc,” he said.

According to data from the General Insurance Association of Indonesia (AAUI), credit insurance claims have increased by 53.1 percent yearly (yoy), reaching IDR 2.94 trillion in the first quarter of 2023. This figure accounts for 29.6 percent of the total claims paid during that period.

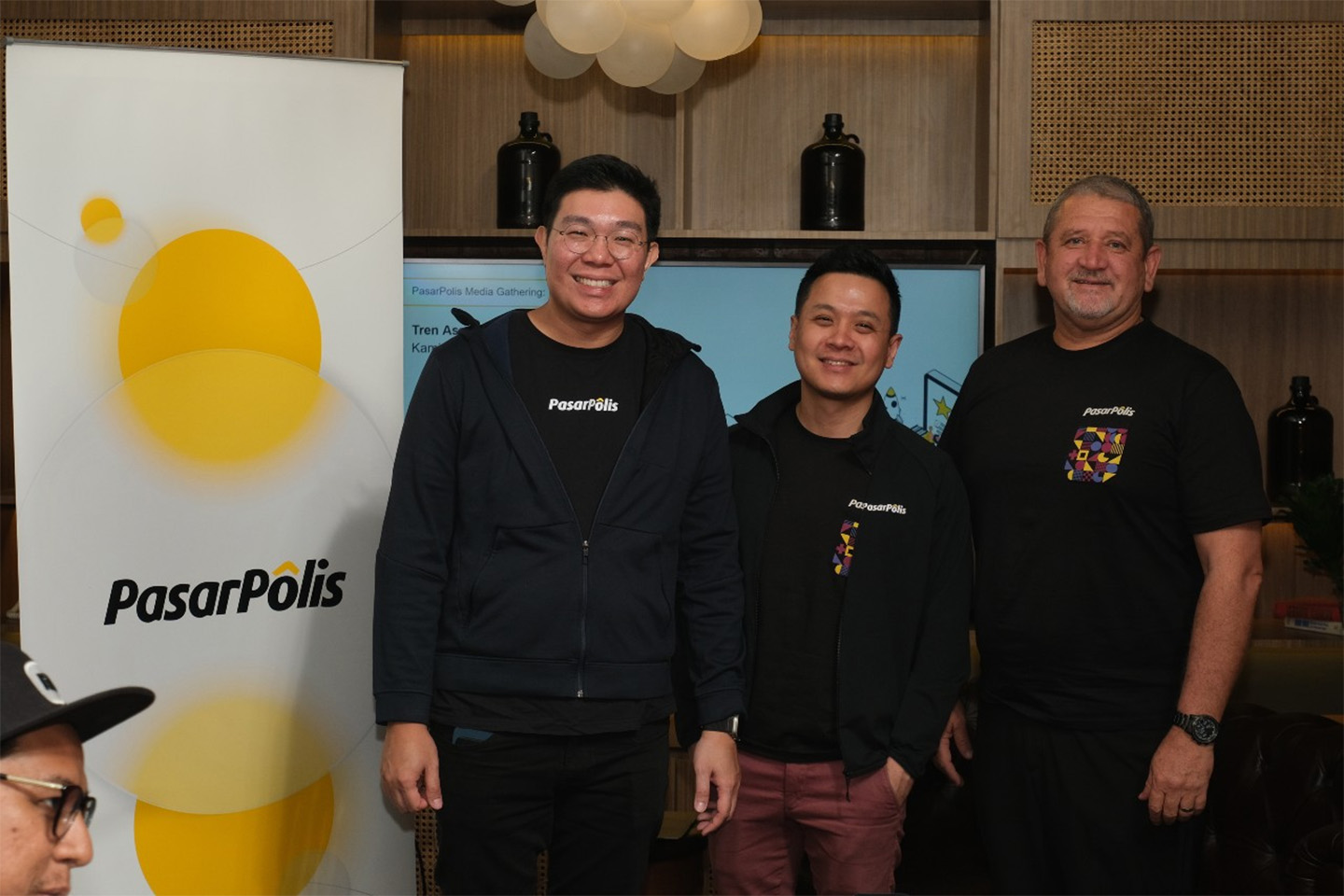

PasarPolis Appoints Peter van Zyl, Insurance Industry Veteran, as New President

KONTAN.CO.ID – Leading insurtech company, PasarPolis, is pleased to announce the appointment of Peter van Zyl as the company’s new President. Peter is a seasoned professional with a long and successful track record in the insurance industry for more than 20 years. Before joining PasarPolis, Peter van Zyl served as President, Director & CEO of Allianz Indonesia for 7 years and held senior management positions at AIG for over 15 years. His expertise in understanding market needs and managing team dynamics is an essential factor in the success of the company he leads.

“It is an honor for me to join PasarPolis. This decision was driven by my motivation to participate in the revolution of the insurance industry, especially in Indonesia. During my two decades of career in the insurance world, I have seen first-hand the transformation of digital products and the huge potential in the insurtech landscape “MarketPolis’ excellence in offering microinsurance, efficient claim procedures, and the application of technology will make this industry more dynamic and easily accessible to anyone,” said Peter van Zyl, President of PasarPolis.

As the leader of the company, Peter has a unique approach. He understands the importance of corporate culture and personal relationships in creating effective partnerships and achieving mutual success. Through personal interactions with team members and business partners, Peter strives to optimize individual potential and create an enabling environment to achieve the company’s mission.

“We are confident that Peter will become an important pillar in strengthening PasarPolis’ position as a leading insurtech company in Southeast Asia focusing on digital insurance products and services. His ability to think strategically, execute plans optimally, and communicate effectively at all levels will support the company’s mission to democratize insurance, making it easy, practical, affordable, and fun through technology and innovation,” said Cleosent Randing, CEO of PasarPolis.

In the short term, Peter will focus on efforts to strengthen PasarPolis’ position in the market and implement new strategies to increase the company’s competitiveness. In the long term, Peter’s vision is to make PasarPolis the leading digital insurance company with easy, fast, affordable services, products, and claims.

Through a digital approach, PasarPolis can reach market segments that are difficult to reach through traditional distribution channels. The products offered by PasarPolis are also very relevant to the needs of today’s society, such as travel insurance and electronic device protection, so PasarPolis helps to increase awareness of the importance of having insurance in everyday life.

As proof of this success, only in 2022, PasarPolis issued more than 500 million policies. Until the end of 2022, PasarPolis has protected nearly 30% of Indonesia’s population or more than 80 million customers. Interestingly, 9 out of 10 users of PasarPolis digital services are individuals who have never bought or used insurance before.

In addition, in line with PasarPolis’ commitment to providing fast and efficient services to customers, especially in innovating the claim process to make it more effective, the company’s data as of the end of June 2023 shows that PasarPolis has succeeded in completing the claim process for non-credit insurance products in less than 24 hours. Process claims for gadget insurance products in less than 1 hour.

Peter is committed to continuing to build on this positive achievement and helping more individuals and families in Indonesia deal with the unexpected. This aligns with PasarPolis’ vision and mission to provide the proper protection solution by providing extra comfort and peace of mind to everyday customers.

Through collaboration with general insurance company Tap Insure, PasarPolis has become a full-stack digital insurance ecosystem capable of underwriting products independently. As a leading insurtech company in Indonesia, PasarPolis currently has more than 7,500 active partners and works closely with more than 40 ecosystem partners to meet the insurance needs inherent in people’s lives in various regions in Indonesia.

The distribution of coverage with the Bank will be included in the New Credit Insurance Policy.

KONTAN.CO.ID – JAKARTA. The problem that is currently becoming a concern is the increase in credit insurance claims. In this case, the credit contribution from the banking industry also plays a role.

The Indonesian General Insurance Association (AAUI) noted that total credit insurance claims in the first quarter of 2023 reached IDR 2.94 trillion, an increase of 53.1% YoY. Most claims come from people’s business loans (KUR), consumer loans, and working capital loans.

The Financial Services Authority (OJK) is planning a new policy related to this credit insurance business. One of the crucial points is the redistribution of coverage risk. This means that credit insurance risk will not be fully transferred to the insurance company but will be partially borne by the bank.

“At the bank, around 20% or 30% of the risk will be borne by the bank, and the rest will be transferred,” said OJK Chief Executive for the Supervision of the Non-Bank Financial Industry (IKNB), Ogi Prastomiyono.

Meanwhile, the Chief Executive of the OJK Banking Supervision, Dian Ediana Rae, explained that credit insurance is part of credit risk mitigation. In its implementation, banks must carry out proper and prudential assessments.

Dian stated that the distribution of the coverage risk is a civil agreement, which means that the bank and insurance must conduct a professional analysis of all aspects.

In preparing this policy, Dian stressed that applying prudential regulations for banking would be emphasized, and banks must choose insurance professionally and consider the health of their insurance correctly.

“I will ensure that the banking supervisor coordinates with the insurance company supervisor to ensure that the governance of the credit insurance process can run professionally and by applicable regulations,” he added.

President Director of Maybank Indonesia, Taswin Zakaria, stated that credit insurance is usually used for government assistance programs such as KUR or micro-credit. At Maybank, credit insurance is used to finance motorbikes/cars or KTA/credit cards in the form of credit life insurance.

“However, insurance will only complete credit if the debtor dies,” he explained.

Based on financial reports in the first quarter of this year, Maybank recorded insurance premium expenses of IDR 17.99 billion, an increase from the same period the previous year of IDR 15.9 billion.

Taswin believes that the distribution of credit risk depends on specific segments, where some banks are willing to bear 20-30% of the credit risk. Suppose a bank is not interested in the risks in a specific segment but must participate in a particular program. In that case, the bank will ask insurance to cover 100% of the risk, or the bank will not participate in the program.

“Everything depends on whether the bank will take the credit risk. If not, the bank will ask insurance to cover 100%,” he said.

Meanwhile, BTN Director of Risk Management, Setiyo Wibowo, said that BTN has divided credit risk, especially in subsidized mortgages and credit, where BTN only hands over 80% of the risk to insurance companies.

“Generally, no insurance company wants to cover 100% of the NPL risk, a maximum of only 80%,” added Setiyo.

However, he emphasized that credit insurance should only be a solution if credit is in trouble. More important is how banks select creditworthy customers and consider appropriate collateral.

Setiyo also stated that there were other factors besides the premium rate in choosing a credit insurance product. The problem of credit insurance price competition is also one of the problems which will be regulated in the policy.

“The main thing is to choose a healthy and strong insurance, which can pay claims,” he added.

Bank Mandiri Director of Risk Management Ahmad Siddik Badruddin explained that Bank Mandiri has implemented a risk-sharing scheme to implement insurance or credit guarantees. According to him, in the KUR and KUM programs, the insurance company bears between 70-80% of the risk and the rest by the bank.

From the perspective of an observer, Amin Nurdin, Senior Faculty of the Indonesian Banking Development Institute (LPPI), explained that there should be risk sharing between banks and insurance companies in credit insurance. Insurance companies are supposed to cover 70% of the risk.

However, he also stated that the emergence of the wrong perception that insurance companies bear 100% risk needs attention. For example, if a debtor has a loan of Rp. 100 billion has paid off around Rp. 30 billion but then experiences terrible credit. The claim submitted to the insurance company is as if the insurance entirely covered it. The actual portion of the insurance company is only 70%, according to the premium paid.

Therefore, according to Amin, the regulator, in this case, the OJK, needs to review the premium amount, which must consider future claims and oversee the insurance company’s governance.

This problem of increasing credit insurance claims does require the right solution. Banks and insurance companies must share risks fairly and transparently and ensure compliance with applicable regulations. This will help build a healthy and sustainable credit insurance industry, and protect both parties, namely banks and insurance companies, as well as their customers.

Disaster Insurance Financing, AAUI Encourages Expansion

Bisnis.com, JAKARTA — Disaster insurance run by the government involving a private consortium is considered necessary for financing national recovery. Director of PT Reasuransi Maipark Indonesia Heddy Agus Pritasa said that currently, disaster issues are a concern in the region. Countries that are members of the Association of Southeast Asian Nations (ASEAN), including Indonesia, continue looking for financing for creative recovery. “Regarding handling infrastructure damaged by the disaster, indeed, the regulations at the center and the government will be different because of regional autonomy. However, this can be synchronized [with disaster insurance],” said Heddy when contacted by Bisnis last week (12/7/2023). Heddy said the disaster damage financing currently has partnered with an insurance company. The government pays disaster insurance premium contributions using the APBN or APBD. This cooperation program is considered to have been implemented well in the State Property Insurance Consortium (KABMN) program. “This is a strategic partnership between the private and government sectors, known as PPP [public-private partnership],” he said. He also pointed out that all insurance companies could join the consortium. On the other hand, Executive Director of the Indonesian General Insurance Association (AAUI) Bern Dwiyanto said that insurance could mitigate the risk of loss/damage to property, property, and/or interests insured.

“This insurance is important, especially for a country like Indonesia, which can be considered complete with the risk of natural disasters,” said Bern. However, he continued, many people still do not realize the importance of having insurance. As for insurance use, this property is mainly dominated by office buildings and industrial. While there are many disaster events, such as floods, the risk of residential houses is often affected. Regarding the protection of government buildings which are state assets, AAUI, together with the Directorate General of State Assets (DJKN), has a program, namely State Property Insurance (ABMN). “When there is a disaster, the risk of damage is transferred to the private sector,” he said. He held that his party was very supportive because this was the government’s effort to secure state property from an incident or risk that could harm the country’s assets and to maintain the certainty of the continuity of public services, support the smooth running of the tasks and functions of administering government. Besides that, it can also support the penetration and growth of the insurance industry in Indonesia. The ABMN was first rolled out in 2019. Bern said that up to now, around 76 Ministries and Agencies are participating in the ABMN program, which is still relatively small compared to the total buildings/offices owned by the government. “It is hoped that more ministries and government agencies will participate in the ABMN program in the future,” he said.

Source:

Travel Insurance is Projected to Continue to Grow Post-Covid-19

Bisnis.com, JAKARTA— It is projected that travel insurance will experience growth after the Covid-19 pandemic. This is due to the increasing need for travel protection as the number of people traveling increases.

Edhi Tjahja Negara, President Director of PT Zurich Asuransi Indonesia Tbk, said that global travel insurance growth is estimated at 17.3 percent this year. He also believes that the travel insurance market in Indonesia will exceed this figure.

Edhi explained that demand for travel insurance from Zurich was very positive this year. After lifting the Covid-19 pandemic status in Indonesia in 2023, Zurich recorded a significant increase in the number of travel insurance policies received by companies in the first half of 2023, which was 800 percent compared to the first half of 2022.

This is due to a better understanding of the public about the benefits of travel insurance in protecting against potential risks that may occur during a trip.

Zurich provides comprehensive protection to meet customer protection needs while traveling domestically, regionally, and internationally. Insurance premiums start from IDR 25,000, and policy options can be adjusted according to the purpose of the trip, the desired level of protection, and the activities the customer wants to do during the trip.

Zurich offers travel policies, such as round-trip, one-way, or annual policies, with bare, executive, or premiere coverage. Additional options for activities such as adventure sports are also available.

Edhi stressed the importance of travel insurance in providing peace of mind during the trip. With protection from Zurich, customers can obtain compensation for their trips in the event of cancellation or change of trips, delays in baggage and personal items, medical expenses, and other emergencies.

Allianz Indonesia Invites Media to Collaborate to Increase Insurance Literacy & Penetration

Allianz Indonesia, which consists of Allianz Life and Allianz Utama, held an Appreciation and Gathering Night with the Chief Media Editor in Jakarta (12/7) as a form of company appreciation for the media’s support to Allianz in spreading positive news and providing education to raise awareness as well as public understanding of the importance of insurance protection.

This event also introduced the new leader of Allianz Life Indonesia, Alexander Grenz, Country Manager & Main Director of Allianz Life Indonesia, to around 30 Chief Media Editors who attended. In addition, this event was also attended by Sunadi, President Director of Allianz Utama Indonesia, and other senior members of Allianz Indonesia’s management.

At this event, the Media Editors who attended had the opportunity to enjoy a dinner full of surprises, according to the theme “Life is Full of Surprise Dinner,” served by Chef Andrian Ishak from Namaaz Dining, the first molecular gastronomy restaurant in Indonesia.

The series of menus depicts the surprises everyone can experience when going through the five stages of life’s journey, such as dreams, hopes, challenges, progress, and results to be obtained, where Allianz will always be there to assist customers in each stage.

Allianz Indonesia believes that the media has a vital role in disseminating accurate and reliable information and shaping public opinion amidst the onslaught of various information and social media with the development of technology and the current digital world.

For this reason, Allianz invites the media to collaborate with insurance industry players, regulators, associations, and other stakeholders to maintain trust in the insurance industry so that insurance literacy and penetration can increase.

Seeing the level of insurance penetration in Indonesia which is still low compared to the Gross Domestic Product (GDP), which is 3.18% (OJK data for 2021), and the penetration rate for sharia insurance is even lower, which is below 1% (OJK data for 2020 ), Allianz Indonesia through its two entities, Allianz Life and Allianz Utama, strives to provide comprehensive insurance protection through products that suit the various developmental needs of the Indonesian people.

Starting from life and health insurance, sharia, and general insurance, strengthening Allianz Indonesia’s position as a provider of insurance solutions and services for the Indonesian people. This is in line with Allianz Indonesia’s mission to protect the future of customers (secure your future) and more Indonesians (to ensure more Indonesians).

“Allianz Life Indonesia continues to maintain its performance in challenging market conditions. This is thanks to our ongoing commitment to protect our customers and their future. Through the Allianz ONE approach used, Allianz Life and Allianz Utama, and Allianz Syariah, which will be independent shortly, will continue to provide comprehensive, best-in-class, and sustainable insurance solutions for the people of Indonesia,” said Alexander Grenz, Country Manager & Main Director Allianz Life Indonesia.

In line with this commitment, Allianz Utama recently collaborated with Allianz Life to launch a new initiative through a new feature in Allianz Discover, making it easier to issue general insurance policies in an integrated manner, namely Tag On.

Allianz Discover is a digital sales application launched in 2015 and functions as a medium for marketers to submit insurance for prospective customers online.

Through the Tag On initiative, Allianz provides customers access to multiple products for various needs, such as life, general, and sharia insurance.

“Allianz Utama and Allianz Life are committed to always accompanying customers’ life journeys through insurance protection solutions to achieve the goals of Indonesian people’s lives. For this reason, Allianz cooperates with various media to continue to disseminate correct and correct information and educate the public about insurance and financial management through various educational activities carried out, starting from mentoring programs, webinars, and educational articles on the Allianz Indonesia website, “said Sunadi, President Director of Allianz Utama Indonesia.

To protect more Indonesian people, Allianz will continue to focus on and continuously improve digital innovation in providing insurance services and expanding the insurance solutions offered. Moreover, seeing the potential of the Sharia market in Indonesia, Allianz is also committed to supporting its development by preparing a Sharia Unit spin-off.

This information is presented by L&G Insurance Broker – The Smart Insurance Broker.

—

LOOKING FOR INSURANCE PRODUCTS? DON’T WASTE YOUR TIME AND CONTACT US RIGHT NOW

L&G HOTLINE 24 HOURS: 0811-8507-773 (CALL – WHATSAPP – SMS)

website: lngrisk.co.id

E-mail: customer.support@lngrisk.co.id

—